+1 661-253-3303

> Offshore Company > Caribbean Offshore Companies > Nevis Offshore Companies

Nevis Offshore Companies

> Offshore Company > Caribbean Offshore Companies > Nevis Offshore Companies

Nevis Offshore Companies

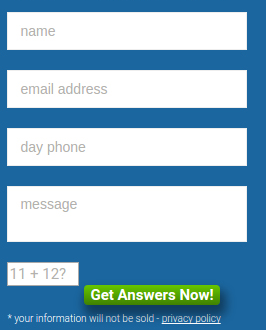

FREE CONSULTATION

Nevis Offshore Companies

In recent years, the small Caribbean island of Nevis has rapidly become one of the convenient and appealing Offshore Company Locations in the world through the enactment of the Nevis Business Corporation Ordinance Act 1984. The island’s authorities have made a Nevis Offshore Company an extremely attractive proposition due to simplicity and ease of formation and implementation. The foresight and forward-thinking attitude of the Nevis government towards the development and administration of the corporate registry enables complete cooperation and unrivalled dedication to those interested in investing or incorporation process in Nevis.

When choosing an offshore financial centre, it is important to consider these factors and benefits:

- Political Stability within the jurisdiction

- Governmental Policy of maintaining Offshore Haven status

- Confidentiality and Anonymity provided by statute

- Tax Exemption provided by Statute for a Nevis Corporation

- Excellent communication facilities

- Accessibility of the Offshore Haven.

All of the aforementioned benefits are evident when considering forming a Nevis IBC or a Nevis Offshore Company on the island. This offshore financial centre provides a stable, convenient and discreet location in which to do business when the use of an offshore jurisdiction would be beneficial or essential, whether for tax or asset protection reasons.

The Nevis Business Corporation Ordinance Act 1984 is an extremely flexible international business statute which incorporates both American corporation law and English company law concepts:

- No taxes are imposed in Nevis Corporations upon income.

- Nevis has Limited Liability Company — Nevis LLC— legislation, which offers far superior asset protection to the company law of other offshore jurisdictions.

- Nevis asset protection provisions are superior to that of other offshore financial centres.

- Nevis Corporation dividends or distributions which are not earned on the island are not subject to taxation.

- It is not necessary to file annual reports or financial returns

- The main / principle office and any records for a Nevis Offshore Company may be located anywhere in the world.

- Directors, Officers and Shareholders do not need to be citizens or residents of the Island of Nevis.

- A corporation may act as Director and as Secretary.

- Bearer shares are permitted with a Nevis Corporation.

Types of Nevis Offshore Company

It is possible to form both Offshore Corporations and Limited Liability Companies (LLCs) through Nevis. The Nevis LLC’s offers vastly superior asset protection and wealth management to other offshore financial centres.

Benefits of Incorporating in Nevis

The main benefits of incorporating in Nevis are the following:

- Privacy of ownership – owners’names are not listed in the public records.

- Asset protection – the Nevis LLC offers maximum asset protection so that when a member (“owner”) of an LLC is sued and a legal judgement ensues, there are provisions in the law which means that the company and the assets inside the company are protected from seizure.

- Speed & Efficiency – Nevis Offshore Companies can be established within 24 hours.

- Cost – Instead of the usual £2500 to £4000 to form an offshore company, a Nevis LLC is only £795 / €1195.

Nevis Company Formation Services

- Nevis LLC £795

- Nevis LLC plus Caribbean bank account £950

- Nevis LLC plus Swiss Bank account £1050

- Nevis complete management programme £1795

Nevis Company Complete Management Package

Option 4, the full management programme, costing £1795, will cover all of the following services, including incorporation of your Fiduciary Structure, with courier fees being the only additional cost. The Fiduciary Structure will have a £1295 annual renewal fee, which covers all documentation and requirements. Through our complete offshore company management package, Offshore Company UK makes it easy for you to form an offshore company in Nevis and then manage it to ensure effective asset protection and privacy. See what is included below.

The Nevis Complete Management Package includes:

- Formation of an asset protection Nevis Limited Liability Company

- Offshore bank account in a Class A top-rated bank (at time of incorporation)

- Nevis postal address with letter forwarding.

- Nevis telephone number answered by a live receptionist.

- Nevis fax number.

- Annual registered agent fee.

- Annual government fee.

- Maintenance of bank accounts.

- Nominee directors & officers.

- Debit card (at time of incorporation).

- Brokerage accounts (at time of incorporation).

- Online access to bank and brokerage account.

- Power of attorney giving you 100% control.

Alternative Offshore Financial Centres in The Caribbean

The Bahamas and The British Virgin Islands are alternative offshore jurisdictions within the Caribbean in which you can protect your assets.